21+ 5 mortgage calculator

20 years 10 months. Where the prepayment charge is an interest rate differential the calculator tool estimated tool results will be in most cases be a higher amount than the actual prepayment charge.

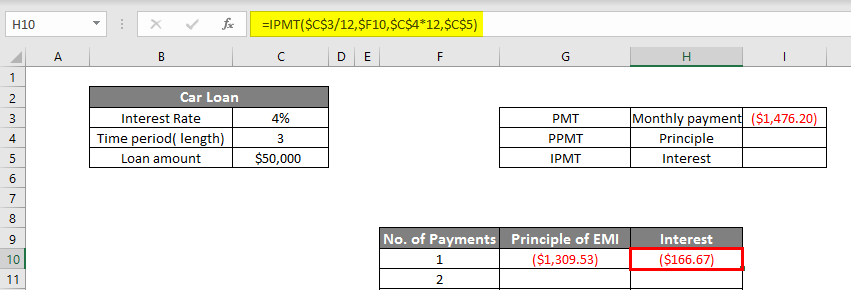

Excel Mortgage Calculator How To Calculate Loan Payments In Excel

These are also the basic components of a mortgage.

. By the second year this is reduced to 4. Mortgages are how most people are able to own homes in the US. If a person.

NACAs Housing Counselors work with members to prepare them for homeownership including determining an affordable mortgage payment consisting of the principal interest taxes insurance and HOA. The land mortgage calculator returns the payoff date total payment and total interest payment for your mortgage. As mentioned above mortgage points are tax deductible.

22 years 4 months. Provides graphed results along with monthly and yearly amortisation tables showing the capital and interest amounts paid each year. This will be the only land payment calculator that you will ever need whether you want to calculate payments for residential or.

21082016 Help to Buy ISA Savers Blocked From Using Bonus Funds For House Deposit 500000 potential ISA account holders unaware of small print preventing use of the bonus against the house. For instance if you take a 5-year fixed-rate mortgage the penalty fee is usually 5 for the first year. This ranges between 1 to 5 of the mortgage balance.

- Your mortgage was funded under a specialty program for example Progress Draw Construction mortgage. The Mortgage Calculator is crucial in determining the mortgage amount based on an affordable monthly mortgage payment. The loans are typically promoted to older homeowners and typically do not require monthly mortgage payments.

The mortgage calculator spreadsheet has a mortgage amortization schedule that is printable and exportable to excel and pdf. Mortgages can seem like an intimidating process but with a mortgage professional assisting you each. Use our comprehensive online mortgage calculator which shows the monthly interest only and repayment amounts on a mortgage.

Here are some of the advantages of a 15-year mortgage over a 30-year mortgage. While the maximum affordable mortgage. Loan Amount Down Payment Loan Term 1 years 2 years 3 years 4 years 5 years 6 years 7 years 8 years 9 years 10 years 11 years 12 years 13 years 14 years 15 years 16 years 17 years 18 years 19 years 20 years 21 years 22 years 23 years 24 years 25 years 26 years 27 years 28 years 29 years 30 years 31 years 32 years 33 years 34 years 35 years Additional Months 0 mont.

Vacant Land Loan Calculator to calculate monthly mortgage payments with a land contract amortization schedule. If you paid an extra 500 per month youd save around 153000 over the full loan term and it would result in a full payoff after about 21 years and three months. Mortgage Calculator Excel spreadsheet is an advanced mortgage calculator with PMI taxes and insurance monthly and bi-weekly payments and multiple extra payments options to calculate your mortgage payments.

On conforming mortgages this fee typically runs somewhere between 750 to 1200. A reverse mortgage is a mortgage loan usually secured by a residential property that enables the borrower to access the unencumbered value of the property. - Your current term began prior to January 2010.

A mortgage usually includes the following key components. Imagine a 500000 mortgage with a 30-year fixed interest rate of 5. Early Mortgage Payoff Examples.

A Scotiabank mortgage calculator is a great head start to the road to home ownership and for a greener home Scotiabank has a home energy savings calculator that offers suggestions for upgrades money-back rebates and simple ideas to help. Borrowers are still responsible for property taxes or homeowners insuranceReverse mortgages allow older. Build home equity much faster.

While both loan types have similar interest rate profiles the 15-year loan typically offers a slightly lower rate to the 30-year loan. People typically move homes or refinance about every 5 to 7 years. In the US the most common mortgage loan is the conventional 30-year fixed-interest loan which represents 70 to 90 of all mortgages.

Origination fees are negotiable but they help a lender cover their basic overhead mitigate the risk a consumer may pre-pay their mortgage before the overhead is covered. Mortgage Overpayment Calculator Use our Mortgage Overpayment Calculator to see how overpaying your mortgage payment can reduce the total cost of your. Loan origination fees are not.

How To Create The Perfectly Organized Fridge And Freezer Refridgerator Organization Refrigerator Organization Fridge Organization

Swimming Pool With Slides Ideas 25 Fun Inspirations For You Divesanddollar Com Backyard Pool Cool Pools Amazing Swimming Pools

Email Sign Up Sheet Template Sign Up Sheets Sign In Sheet Template Business Template

Trading Card Retro Style Baseball Card Template Trading Card Template Cards

Excel Mortgage Calculator How To Calculate Loan Payments In Excel

Money Mantras 21 Positive Affirmations For Money That Really Work Money Affirmations Money Investing

Sample Free Construction Estimate Template Excel Template Business Construction Work Estimat In 2022 Estimate Template Excel Templates Business Schedule Template

Cash Flow Projection Templates 5 Free Xlsx Doc Pdf Cash Flow Statement Cash Flow Statement Template

How To Pick Your Retirement Date To Optimize Your Chevron Pension

Design Living Room Maison Design Maison Moderne

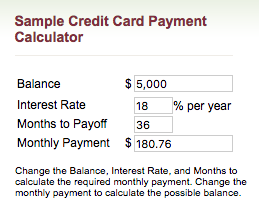

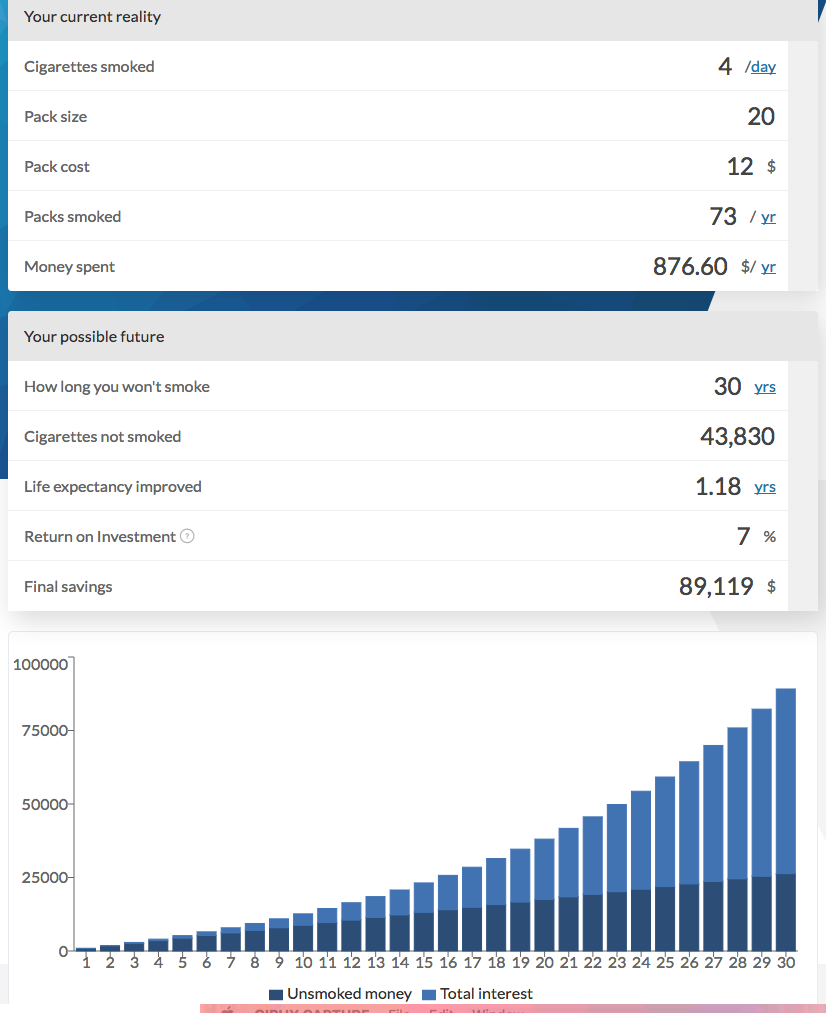

21 Embeddable Calculators To Elevate Your Content Dolphins

Excel Mortgage Calculator How To Calculate Loan Payments In Excel

Term Life Insurance What You Need To Know Before You Buy Here S A Comprehensive Guide To Help You Purchase The Ri Term Life Term Life Insurance Life Insurance

Excel Mortgage Calculator How To Calculate Loan Payments In Excel

Picking Up Fall Essentials Fall Essentials Halloween Kids Cute Halloween

Excel Mortgage Calculator How To Calculate Loan Payments In Excel

21 Embeddable Calculators To Elevate Your Content Dolphins