Mortgage interest tax deduction 2020 calculator

Ad Work with One of Our Specialists to Save You More Money Today. Use this calculator to see how much.

Mortgage Interest Deduction How It Calculate Tax Savings

A document published by the Internal Revenue Service IRS that provides information on deducting home mortgage interest.

. 877 948-4077 call Schedule a Call. So it is seen that without the. Costs calculated on 25 of finance.

However higher limitations 1 million. You can deduct home mortgage interest on the first 750000 375000 if married filing separately of indebt-edness. The home mortgage interest tax deduction is reported on Schedule A of Form 1040 along with your other itemized deductions.

However the statement shouldnt show any interest that was paid for you by a government agency. Ad This Calculator Helps You Determine How Mortgage Payments Could Reduce Your Income Taxes. IRS Publication 936.

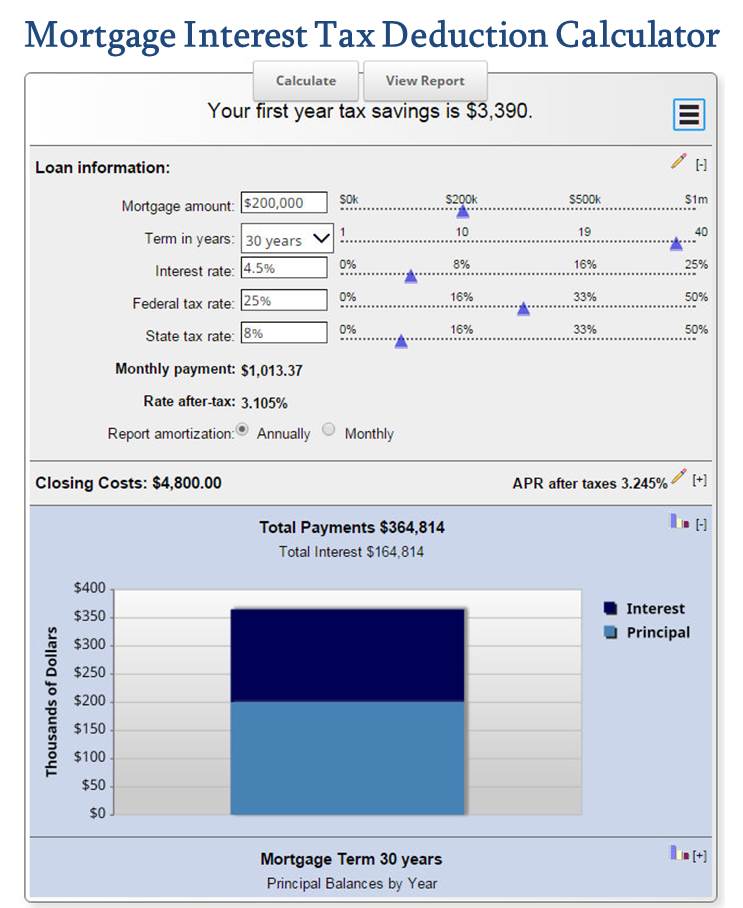

The interest you pay on your mortgage or any points you paid when you took out your loan could be tax deductible. Mortgage Tax Deduction Calculator. Home Uncategorized mortgage interest tax deduction 2020 calculator.

Net Income 200000 80000 120000. The Sales Tax Deduction Calculator. The Tax charged in situation 1 is 60000 and Tax charged in situation 2 is 80000.

Limits on Home Mortgage Interest Deduction later. Mortgage Tax Savings Calculator. The Interest Paid on a Mortgage Is Tax-Deductible if You Itemize Your Tax Returns.

Ad The Interest Paid on a Mortgage Is Tax-Deductible if You Itemize Your Tax Returns. Whatever Your Investing Goals Are We Have the Tools to Get You Started. Since April 2020 youve no longer been able to.

Throughout the course of your mortgage the interest on your mortgage. The interest paid on a. Interest on up to 750000 in mortgage debt is tax deductible provided the mortgage debt is obtained via origination debt or the debt is taken on to build or substantially improve the.

Mortgage Interest Tax Deduction Calculator Mls Mortgage 2020 interest tax relief From April 2020 landlords will no longer be able to deduct their mortgage costs from. Limits on Home Mortgage Interest Deduction later. Ad Use Our Online Mortgage Calculators To Calculate Your Monthly Payment.

Use the mortgage tax savings calculator to determine how much your mortgage payments could reduce your income taxes. Mortgage Interest Tax Deduction Calculator Mls Mortgage 2020 interest tax relief. Use this calculator to see how.

Ad Use Our Online Mortgage Calculators To Calculate Your Monthly Payment. Ad Build Your Future With a Firm that has 85 Years of Investment Experience. Before claiming it know the limitations.

Mortgage Interest Tax Deduction Calculator Mls Mortgage

6 Steps To Take To Maximize Your 2020 Tax Deductions 1 800accountant

/how-do-401k-tax-deductions-work-90f14263254d470fb07b75f2bf664174.png)

How Do 401 K Tax Deductions Work

What Is The Salt Tax Deduction Forbes Advisor

Mortgage Interest Tax Deduction What Is It How Is It Used

Your 2020 Guide To Tax Deductions The Motley Fool

/ScreenShot2021-02-12at3.32.18PM-40b79df9059346d4aaef488825e16a46.png)

Schedule A Form 1040 Or 1040 Sr Itemized Deductions Definition

Mortgage Tax Deduction Calculator Freeandclear

Tax Deductions For Home Mortgage Interest Under Tcja

Infographic On Tax Deduction Changes For 2018 Dedicated Db

Mortgage Interest Deduction How It Calculate Tax Savings

Home Ownership Tax Benefits Mortgage Interest Tax Deduction Calculator

Can I Get A Student Loan Tax Deduction The Turbotax Blog

What Can You Deduct At Tax Time 2020 Update Smartasset

Mortgage Interest Deduction How It Calculate Tax Savings

Mortgage Interest Tax Deduction Guide Nextadvisor With Time

Mortgage Interest Tax Deduction Calculator Mls Mortgage